Generating Form 114 - Report of Foreign Bank and Financial Accounts

by Intuit•3• Updated 3 months ago

How to generate Form 114

To generate Form 114 - Report of Foreign Bank and Financial Accounts:

- Go to the Profile tab.

- In the SELECT FOR E-FILE column, select the box labeled Federal.

- You must select the Federal box to e-file Form 114 and to generate Form 114a.

- In the SELECT FOR E-FILE column, select the box labeled Federal Form 114 (Taxpayer) and/or Federal Form 114 (Spouse).

- Go to the Input Return tab.

- Select Miscellaneous Forms, then Foreign Reporting (114, 8938) to expand.

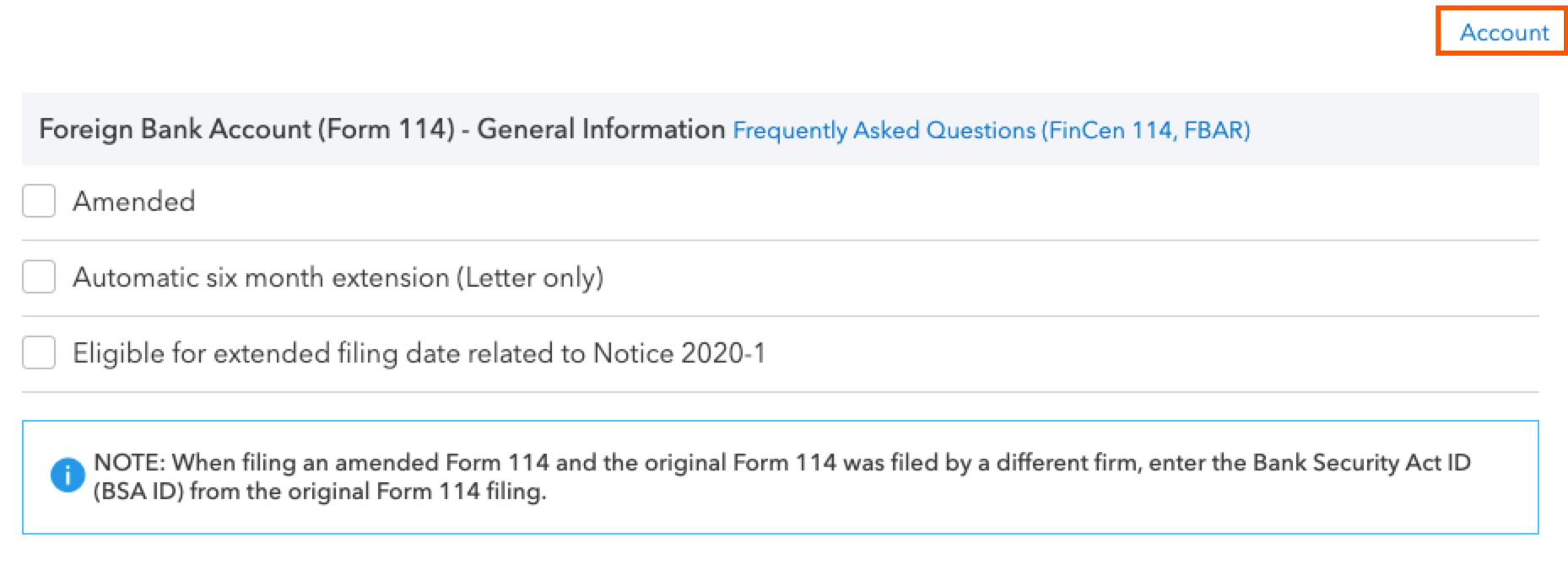

- Select Foreign Bank Account (Form 114).

- Under the section Foreign Bank Account (Form 114) - General Information, enter any applicable information.

- Select the Account tab.

- On the left-side menu, click on Foreign Bank Account (114).

- Under the subsection Information on Financial Accounts in the field, Type of account: 1=bank acct., 2=securities acct., or specify, enter a 1 or 2.

- Enter the Maximum value of account (-1=unknown).

- Under the subsection Financial Institution, enter the Name of institution (Line 1) (MANDATORY for all accounts).

- Fill in the remaining Financial Institution fields that apply.

- Complete any other information that applies to this account.

- Select the plus sign ( + ) to add another account.

Additional information:

- ProConnect Tax won't generate Form 114 when Form 1040NR is present in the return. This is due to the filing requirements for Form 114.

- FinCEN Form 114 no longer supports the old e-file format that the program used in tax year 2016 and earlier. At this time, you can e-file tax years 2024, 2023 and 2022 through ProConnect Tax.

- Prior year returns may be filed directly at the FinCEN website.

- Form 114a must be signed by the account owner and spouse, when applicable. The form isn't e-filed with the return, but preparers must keep copies of Form 114 and Form 114a for five years.

- FinCEN Form 114 is usually available in mid-January. See Tax form finder for up to date information.

Form 114 country codes:

Per the FinCEN XML User Guide, you can find the current code lists in the following places:

- For U.S. address use only the authorized U.S. USPS state, territory, or military address abbreviations found in Publication 28 - Postal Addressing Standards.

- For Canadian provinces and territories, use the Canada Financial Crimes Enforcement Network FinCEN FBAR XML Schema User Guide.

- For Mexican states and territories, use the ISO 3166-2 three-letter codes.

- For all countries use the ISO 3166-1 two-letter country codes found on this webpage.

- Additional information about ISO 3166 codes can be found on the BSA E-Filing Program website.

The ISO 3166-2 country list contains the code “UM” that stands for the United State Minor Outlying Islands. Using “UM” in country fields is prohibited. These islands are uninhabited. As such they have no addresses.

Related topics

More like this

- Electronically filing Form 114, Report of Foreign Bank and Financial Accounts in ProSeriesby Intuit

- How to resolve Lacerte diagnostic ref 40377 - Invalid setup: No Form 114 in the returnby Intuit

- E-filing Form 114 (FBAR) in ProConnect Taxby Intuit

- How to resolve ProConnect Tax diagnostic Ref 40376 Invalid setup: Form 114 for the spouseby Intuit