Entering Form 1099-B Box 11 aggregate profit on contracts in ProConnect

by Intuit• Updated 3 years ago

To enter Form 1099-B, box 11, aggregate profit (or loss) on contracts:

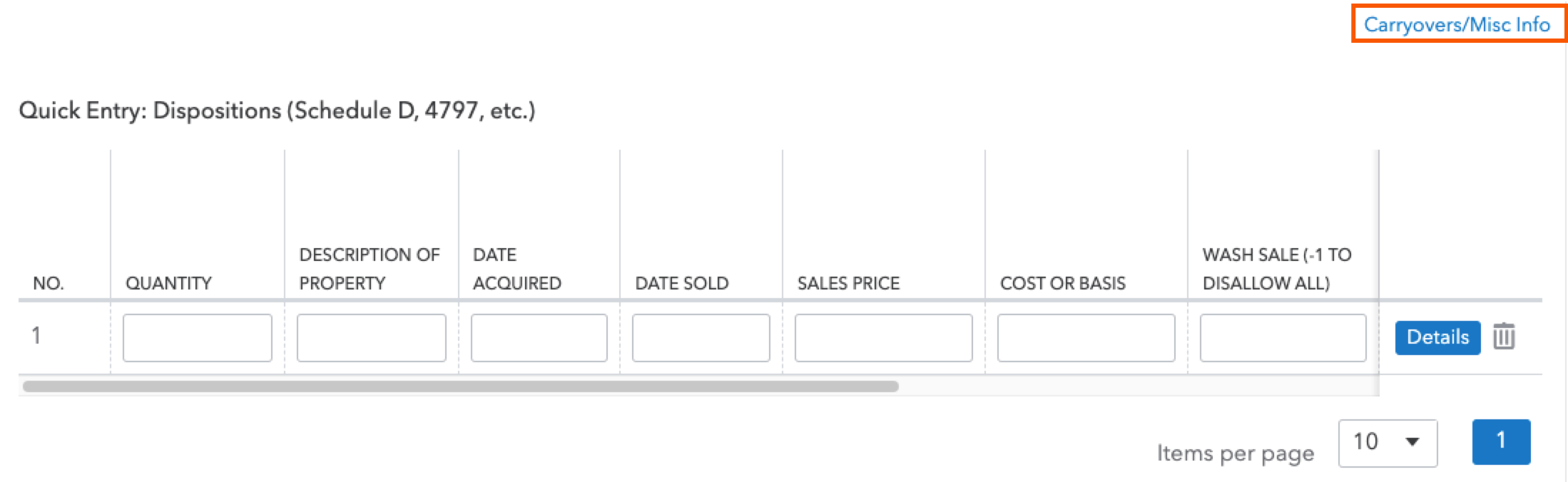

- Go to the Input Return tab.

- Select Income, then expand Dispositions (Sch. D, etc.).

- Select Schedule D/4797/etc.

- Locate the transaction in the Quick Entry grid.

- Select Carryovers/Misc Info.

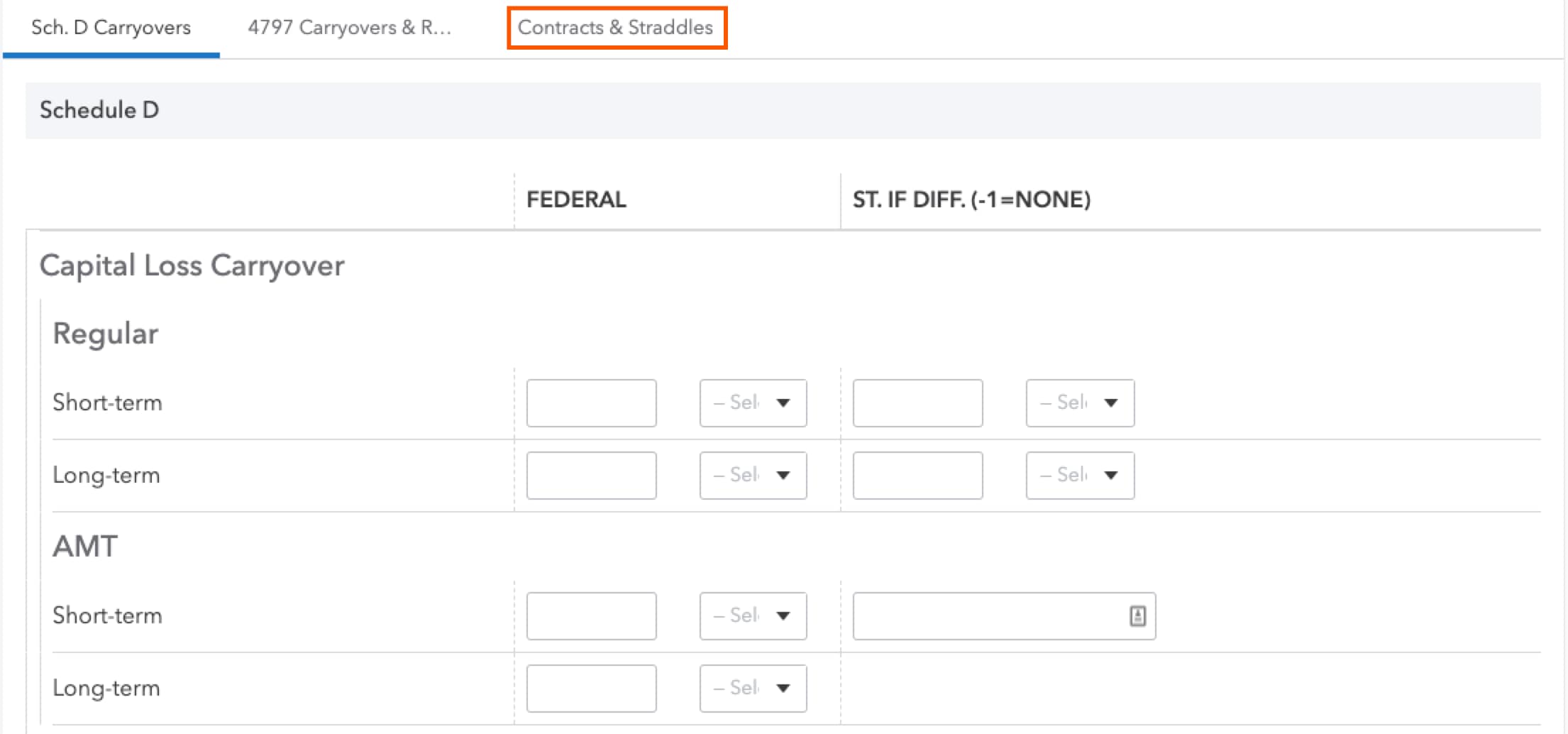

- Select the Contracts & Straddles tab.

- Under the section Contracts and Straddles (6781), select all applicable boxes.

The amount will flow to Form 6781 to be included on Schedule D and reported on the return as a capital gain or loss.