Entering Deductions in the Final Year of a Trust or Estate (Form 1041) in Lacerte

by Intuit• Updated 4 weeks ago

A Fiduciary return will let losses to be taken on the Beneficiaries' Schedule K-1 in the Final year of the return.

Follow these steps to distribute items to the beneficiaries in a final year:

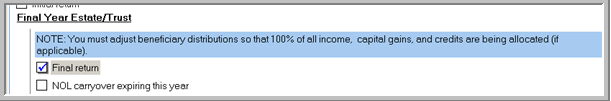

- Go to Screen 2, Miscellaneous Information.

- In the section Final Year Estate/Trust, check the box Final Return.

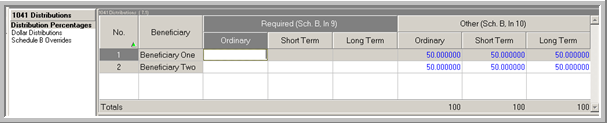

- Go to Screen 7, 1041 Distributions.

- Use the Other (Sch. B, ln. 10) input areas of 1041 Distributions (Screen 7.1 or 7.2) to report the amount of property to which each beneficiary is succeeding.

- Note: You may use either dollar amounts or percentages, but not both.

Note: The Required (Sch. B. Ln 9) input fields of the 1041 Distributions screens are used to report amounts on Schedule B, line 9, "Income required to be distributed currently." These are Tier I distributions of current year's trust accounting income required to be distributed per the trust instrument (as in a Simple trust). This input area may be used in a final year to distribute current year's income, but distributions of this type do not represent property of an estate or trust to which a beneficiary has succeeded. Therefore, in a final year, Section 642(h) items will not be allocated to beneficiaries receiving only Required (Sch. B. Ln 9) distributions.

Additional Information Regarding the Final Year of a Trust:

Per IRC Sec. 642(h), in the final year of a fiduciary, the following items are allowed as deductions to beneficiaries succeeding to the property of an estate or trust:

- Net operating loss carryover (IRC Sec 172)

- Capital loss carryover (IRC Sec. 1212)

- Certain deductions in excess of gross income in the final year (IRC Sec. 642)

- No other loss items, including suspended passive losses, disallowed investment interest, depletion carryovers, etc. are allowed to the remaindermen succeeding to the property of an estate or trust.

When the return is marked final, the exemption amount on Form 1041, line 20 will not calculate. Since all of the income, gain, credits, etc are being distributed, the exemption will remain zero.

Follow these steps to override the exemption amount:

- Go to Screen 33, Miscellaneous Deductions and NOL.

- Enter the amount you would like to appear on Form 1041, line 20 in the field Exemption [O] (code 1).

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Claim the Exemption on a Final Year Estate on Form 1041 in Lacerteby Intuit

- General information about Form 1041 for ProSeries Professionalby Intuit

- Claim the Exemption on a Final Year Estate on Form 1041 in ProConnect Taxby Intuit

- Common questions about Form 1041 distributions to beneficiaries in ProSeriesby Intuit