Entering a casualty or theft for Form 4684 in ProConnect Tax

by Intuit•2• Updated 2 months ago

How do you enter a casualty or theft for Form 4684 in an Individual return in ProConnect Tax?

You can enter losses in two different areas, depending on whether the loss is personal or business.

How to enter a personal loss for Form 4684, page 1:

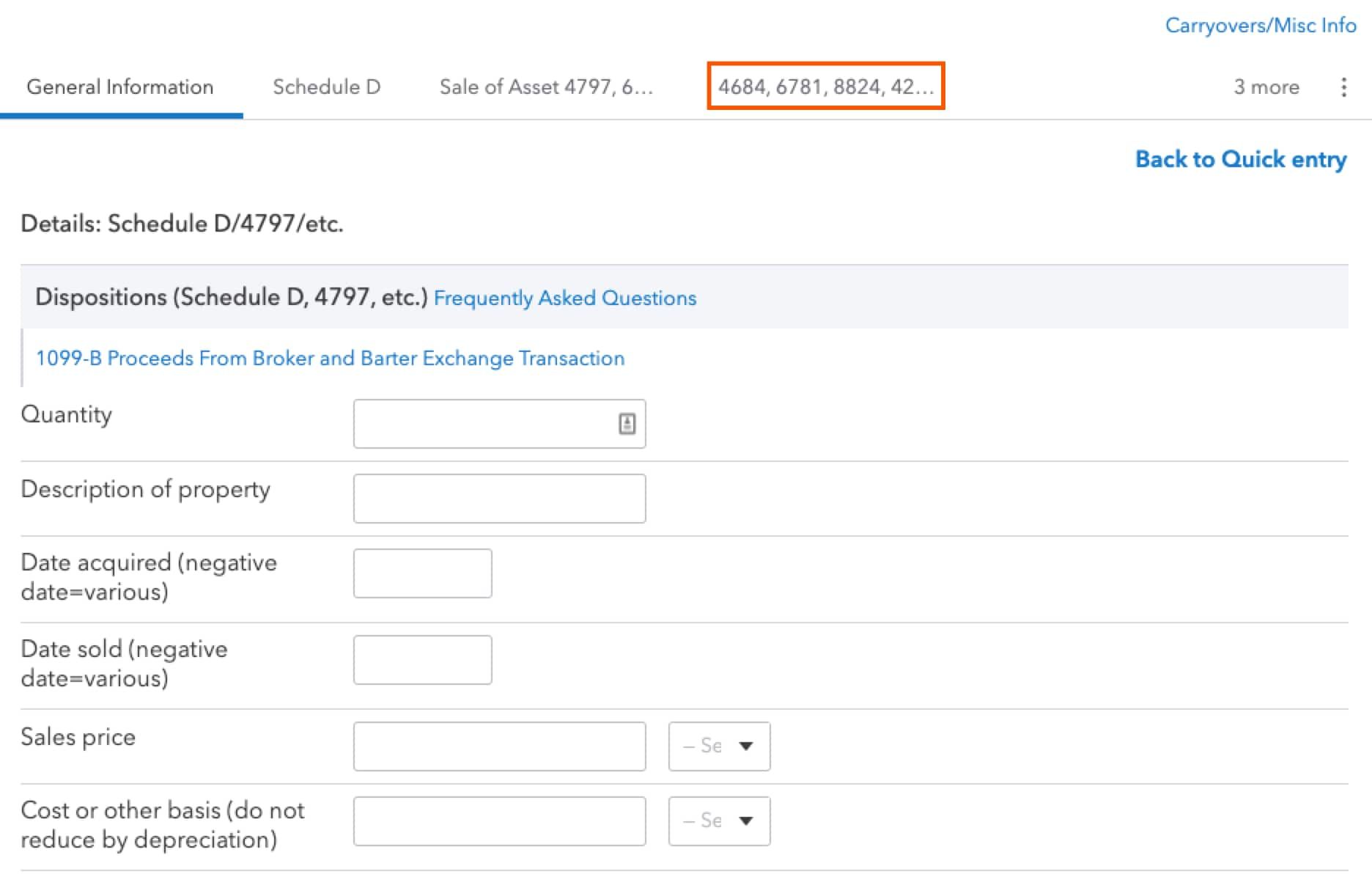

- Go to the Input Return tab.

- Select Income, then Disposition (Sch D, etc.).

- Select Schedule D/4797/etc.

- In the Quick Entry grid, enter the Description of Property and Date Acquired.

- Enter the date of the casualty or theft in Date Sold.

- Enter the Cost or Basis.

- Select Details to expand the input.

- Leave the Sales price blank.

- Select the tab labeled 4684, 6781, 8824, 4255.

- Under the section Casualties and Thefts (4684) in the field 1=personal, 2=business, 3=income, 4=employee, enter 1.

- Fill out any other applicable information.

If treating as personal loss, the Form 4684 will only generate if a Schedule A is generated for the return.

- To force ProConnect Tax to print the lesser of lines 20 and 25 on line 26, enter at least $1 in the field Fair market value after casualty or theft.

How to enter a business loss for Form 4684, page 2:

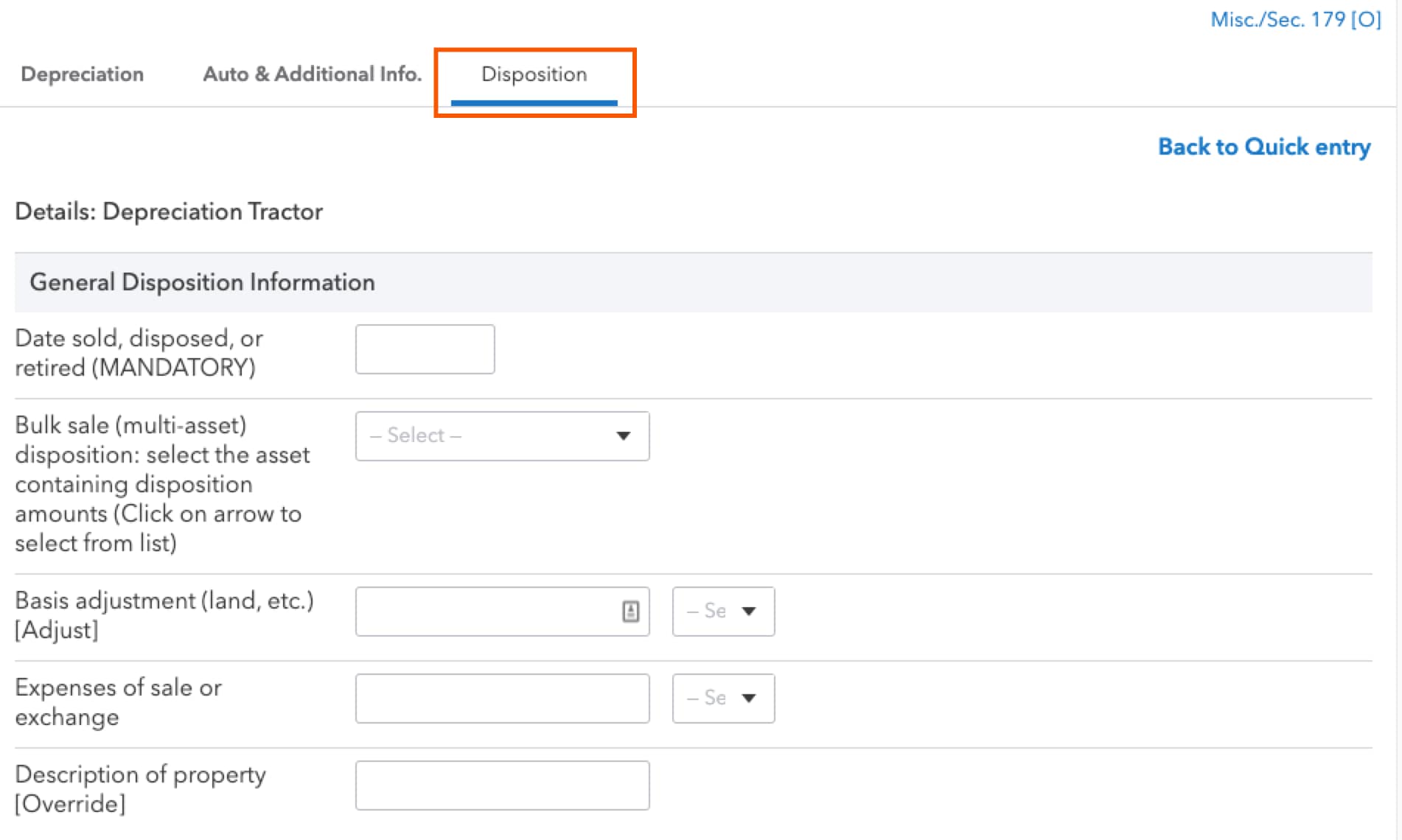

- Go to the Input Return tab.

- Select Deductions, Depreciation.

- Locate the asset that was lost in the Quick Entry grid.

- Select the Details button.

- Select the Disposition tab.

- Under General Disposition Information in the field labeled Date sold, disposed, or retired (MANDATORY), enter the date of the casualty or theft.

- Fill out any applicable information here.

- To force ProConnect Tax to print the lesser of lines 20 and 25 on line 26, enter at least $1 in the field Fair market value after casualty or theft.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Entering a casualty or theft for Form 4684 in ProSeriesby Intuit

- Common questions about Corporate Casualty of Theft in ProConnect Taxby Intuit

- Filling out Form 4684 for casualty and theft in ProConnect Taxby Intuit

- Generating Form 4684 casualty or theft loss for an individual return in ProConnect Taxby Intuit

- Why is Form 4684, line 26 printing the line 20 amount in ProConnect Tax?by Intuit