How to resolve Lacerte diagnostic ref 37488 - Adjustment attributable to municipal bond interest

by Intuit•27• Updated 3 months ago

This article will help resolve the following diagnostic:

- Interest Income Item #X: Adjustments to federal taxable interest exceed federal taxable interest. Adjustments attributable to municipal bond interest (nontaxable) should be removed and the entry(s) in the municipal bond interest field(s) should be reduced (if not already) to reflect the net amount of municipal bond interest. (ref. #37488)

This diagnostic generates when there are municipal bond interests (nontaxable) and adjustments to taxable interest entered. Lacerte won't automatically combine these amounts on the return; they must be reduced manually.

Time saving tip

If nominee interest, accrued interest, or amortizable bond premium is attributable to the tax-exempt interest, don't make entries in Nominee interest, Accrued interest or Amortizable bond premium for such amounts, since entries in those fields reduce taxable interest reported on Federal Schedule B.

Instead, the amount entered in this input field should reflect the reduction for such items. Amounts entered in Nominee interest, Accrued interest and Amortizable bond premium should only be amounts attributable to taxable interest.

Follow these steps to resolve this diagnostic:

- Select Screen 11, Interest Income (1099-INT, 1099-OID).

- Select the 1099-INT (listed in the diagnostic) from the left panel.

- Scroll down to the Form 1099-INT section.

- Locate the Tax-Exempt Interest subsection.

- Reduce the municipal bond interest by any adjustments and enter the amount in Total municipal bonds.

- Scroll down to the Adjustments to Federal Taxable Interest subsection.

- Remove any adjustments attributable to municipal bond interest.

An example

Interest is tax-exempt, so the total interest isn't taxable. However, if some of the tax-exempt interest falls under the definition of accrued interest as mentioned above, it must be taken into account by subtracting accrued interest from the total tax-exempt interest to arrive at the amount of tax-exempt interest that is attributable to the purchaser.

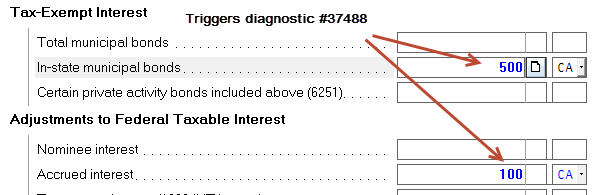

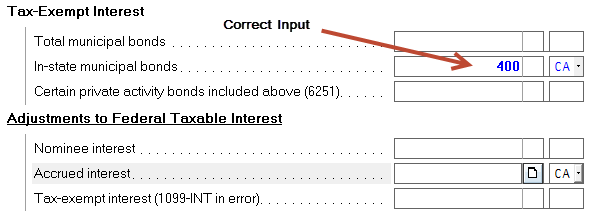

Tax-exempt interest $500, $100 of which is attributable to accrued interest. To properly enter this and resolve the diagnostic, net the amount of Municipal Bond interest by subtracting $100 from the $500 total and entering $400 in the applicable Municipal bond input field. Refer to the screenshots below.

The same principle applies to Nominee Interest and Amortizable Bond Premiums - remove inputs in the Adjustments to Federal Taxable Interest section, net the amount and input in the applicable Tax-Exempt Interest field.

More like this

- How to resolve ProConnect diagnostic Ref 37488 - Adjustment attributable to municipal bond interestby Intuit

- Troubleshooting Lacerte diagnostic ref. 37490by Intuit

- How to enter 1099-INT or 1099-DIV tax-exempt interest in ProConnect Taxby Intuit

- Troubleshooting Lacerte diagnostics ref. 404/405 - Form 2555 W-2 EIN is missing or invalidby Intuit