How are retained earnings calculated on Form 1120 in ProConnect Tax

by Intuit•1• Updated 1 year ago

The program calculates the ending balance of retained earnings for the balance sheet (Schedule L), line 25, using the Schedule M-2. You can view the Schedule M-2 on the last page of Form 1120.

How Schedule M-2 calculates retained earnings

Schedule M-2 calculates the unappropriated retained earnings as follows:

Beginning balance

- Plus book income (from Schedule M-1, line 7)

- Plus other increases

- Less distributions and other decreases

= balance at end of year, Schedule M-2, line 8.

The calculated value on M-2, line 8, prints on the balance sheet, line 25, in the ending column for unappropriated retained earnings. Keep reading to learn where to enter M-2 amounts and how book income is calculated.

Line 1 - Balance at beginning of year

The beginning balance will typically proforma, or roll over, from last year’s return. If the beginning balance is blank or incorrect, follow these steps to enter the right amount:

- Go to Input Return ⮕ Balance Sheet.

- Select Balance Sheet to expand.

- Select Assets, Liabilities and Capital.

- Scroll down to Liabilities and Capital section

- Enter the amount in Retained earnings: unappropriated.

Line 2 - Net income (loss) per books

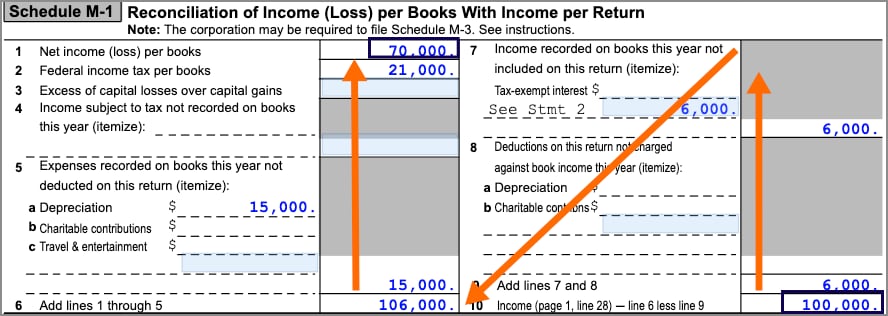

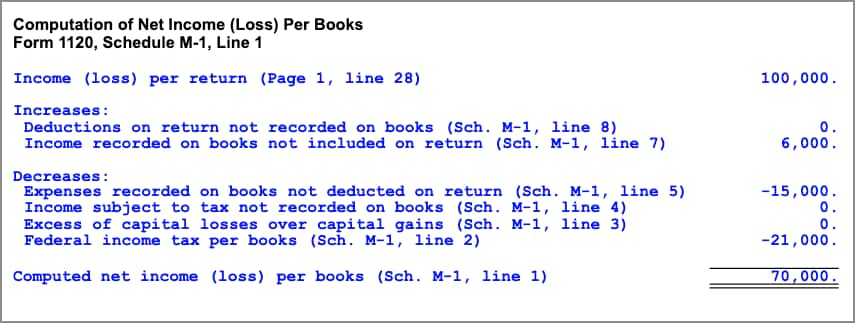

This amount is calculated on Schedule M-1, line 1. The M-1 starts on line 10 with taxable income before NOL and special deductions, and works backward through the lines of M-1 adjustments to arrive at the corporation’s net income per books (Schedule M-1, line 1).

The program also generates a worksheet that shows the computation of net income per books from start to finish.

Schedule M-1 adjustments

Many Schedule M-1 adjustments for lines 2-9 will generate automatically based on your entries throughout the return. To enter additional items or override automatically calculated adjustments:

- Go to Input Return ⮕ Balance Sheet ⮕ Schedule M-1, M-3.

- Select the Schedule M-1 screen.

Lines 3, 5, and 6 - Other increases, distributions, other decreases

To enter other increases, distributions, or other decreases:

- Go to Input Return ⮕ Balance Sheet ⮕ Schedule M-2.

Line 8 - balance at end of year

This total is carried to the balance sheet, line 25, column (d) as the corporation’s ending unappropriated retained earnings.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Balancing an S-Corporate balance sheet on Form 1120-S in ProConnect Taxby Intuit

- Entering distributions in excess of retained earnings for Form 1120S in ProSeriesby Intuit

- How does Lacerte calculate retained earnings for Form 1120S?by Intuit

- How does ProConnect calculate retained earnings for Form 1120S?by Intuit